In a competitive market, it pays to invest in technology that can make brewery management and accounting more efficient, streamlined, and cost-effective. It can also give you greater data oversight of your entire operation.

QuickBooks Online is the best accounting software for small businesses and accounting firms.

The Quickbooks Brewery Integration for Brew Ninja

It is incredibly easy to integrate Quickbooks and Quickbooks Online with Brew Ninja Brewery Management Software and takes most users 10 minutes or less to complete.

Read our help section: Connect Quickbooks to Brew Ninja

Is there a Square Quickbooks integration that works for Breweries?

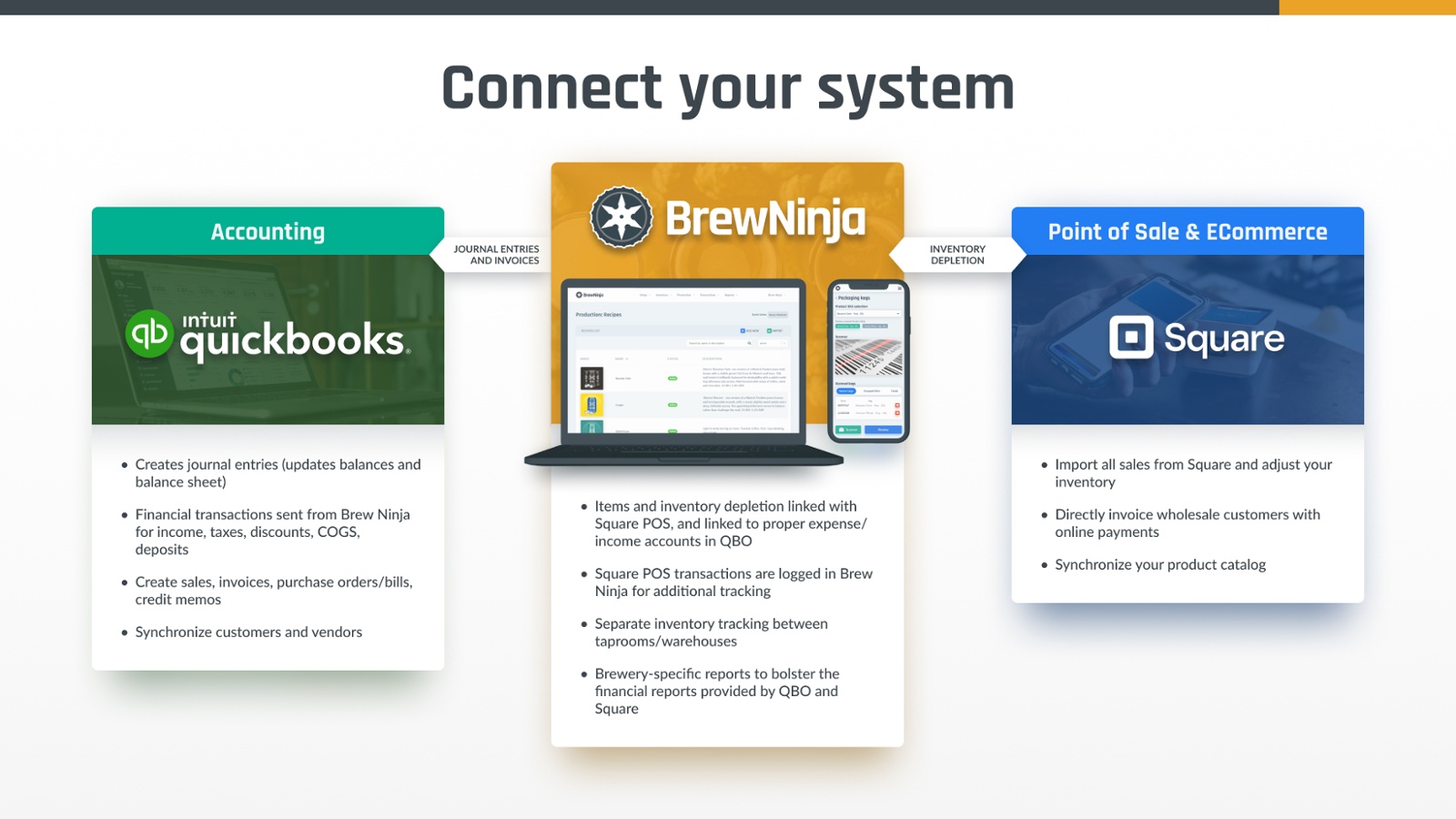

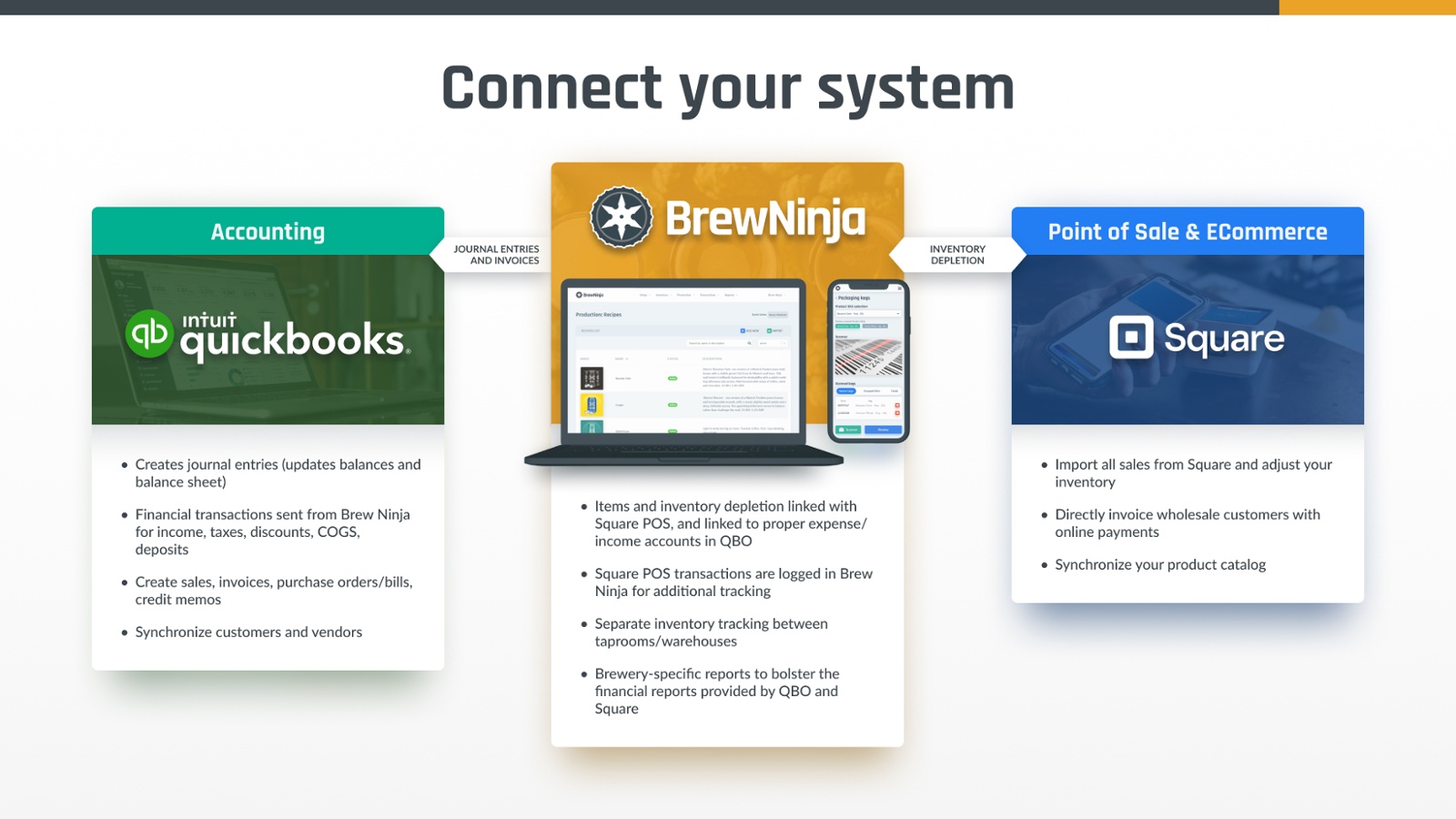

Absolutely, While there are a number of good POS systems for restaurants, food service and tap rooms, such as Arryved - our recommendation is to integrate your brewery’s sales using Brew Ninja, Quickbooks Online and Square POS.

Integrating all three products provides breweries with an end-to-end tax, compliance and reporting system that satisfies governments, brewery owners, taproom managers, book keepers and accountants.

Read more about our Square POS integration for Brew Ninja.

Why integrate using Brewery Management Software?

Breweries can benefit from this set up for a number of reasons, but sometimes those reasons aren’t immediately clear until you dig a little deeper. For example, it’s already possible to connect Square and Quickbooks to track sales from the tap room, so you might question why further integration is needed.

Square POS can handle sales and provide real-time information about what’s left in your kegs. Alongside sales, revenue, and cash received, this data can then be pulled through into Quickbooks. But that’s as far as it goes. It doesn’t calculate the cost of goods sold, or how much money and inventory are left.

Without integrating Quickbooks and Square with a brewery management system like Brew Ninja, production would have to manually check how much was sold through the taproom, or how many cases of beer are left in stock.

With Brew Ninja, when a customer purchases beer, Square POS sends the transaction details to Brew Ninja first.

Our software then deducts the purchase from inventory. It also breaks down any deposits or sales tax payable. Not only that, because Brew Ninja knows the cost of production for every beer sold, it also calculates the revised value of inventory then adjusts the cost of goods sold accordingly.

Brew Ninja then allows all that broken down data to flow through into Quickbooks. So you can see at a glance, in real-time, the value of stock in your taproom. Whilst in most Canadian provinces, there’s no requirement to report the taproom sales, in the US you’re required to know what’s consumed on site.

Craft Brewery Profits & Management Reporting

The great thing about Brew Ninja is that it provides a reliable connection between the cost of production and the cost of sales. Because the cost of production might increase due to fluctuations in the price of ingredients, Brew Ninja actually takes account of this to provide you with a real-time average cost of per keg or pint that you can use to adjust your prices accordingly.

Whilst many craft brewers are aware that Brew Ninja software has the ability to connect with point of sale (POS) and accounting software, they don’t always realize the full potential of that functionality.

With your data fully integrated into Brew Ninja, your team will have live access to profit and margin reports, sell through, availability and more - without the tedious hard work of manual inventory counts and data entry.

Connect the Dots to Save Time & Improve Decisions

Having explored the connectivity between Brew Ninja, Square POS, and Quickbooks, it’s difficult to find a reason not to join the three dots. You only have to imagine the month-end without that connectivity to see the difference it can make - manually retrieving data from different sources to generate reports that Brew Ninja can automate for you.

Detailed Transaction Description for Brew Ninja Quickbooks Integration

- Customers – Two-way synchronization between QuickBooks Online and Brew Ninja.

- Invoicing – A Sales Order is the document in Brew Ninja used for account-based sales. When a sales order has been completed, it can be pushed to QuickBooks Online as an invoice. The signed delivery slips (created and collected by Brew Ninja) are attached to the invoice.

- Retail – Retail Sales in Brew Ninja created in Brew Ninja via our Taproom-POS or our Square POS integration, can be pushed to QuickBooks Online in two ways:

- 1) Each retail sale be pushed to QuickBooks Online as a single Cash Sale.

- 2) Groups of Retail Sales can be pushed to QuickBooks Online as a single Invoice.

- Purchasing – Create and receive (item by item) Purchase Orders in Brew Ninja. When they are complete, they can be pushed to QuickBooks Online as a Purchase Order.

- Raw Materials – Brew Ninja will keep the accounts related to your raw materials value up to date in QuickBooks Online. You have full control of which account a material gets linked to in QuickBooks Online.

- Products – Brew Ninja will keep your list of products in QuickBooks Online up to date. Because Brew Ninja has a very in deep definition of what your products are, the synchronization is from Brew Ninja to QuickBooks Online.

- Environmental Deposits & Levies – Brew Ninja will accurately break out special environment deposits in levies, and place the values in the correct accounts in QuickBooks Online.

- Keg/Equipment Deposits – Brew Ninja will break out keg deposits are separate line items when sales are exported to QuickBooks Online. The money from these line items goes into appropriate short-term-liability accounts.

- Special taxation cases – Brew Ninja helps QuickBooks Online handle situations where the tax collected is based on the cost of a product, not on the selling price. This is a common case in giving away promotional products to your customers.

- Inventory counts and adjustments – When an inventory count is performed in Brew Ninja, the value of the updated inventory count can adjust the accounts in QuickBooks Online . Full control is given to assigning where losses come from based on the reason for the discrepancy (e.g., spoilage, theft, etc).